Business bank account opening in Singapore: Things you should know

Introduction

Singapore has one of the top banking facilities in the world. This city has also ranked as one of the best places to do business in the World Bank’s rankings. The way Singapore is progressing in its banking sector, it is not tough to decipher that its main ambition is to become the key financial and banking hub in the Asia Pacific region. In this blog, we will focus on the business banking sector in Singapore by exploring some of the top things you should know about opening a business bank account in Singapore.

Singapore business banking

As we already mentioned, the banking sector of Singapore is a flourishing one. There are, currently, more than 120 commercial banks operating in Singapore. Out of these around 5% are local banks and the remaining 95% are foreign banks. So, if you are looking forward to exploring the business or commercial bank account opening in this island city-state, there will be no dearth of good options.

The top 5 local banks in Singapore include:

DBS Bank Limited

United Overseas Bank (or UOB)

Far Eastern Bank Limited

Oversea-Chinese Banking Corporation Limited (or OCBC)

Far Eastern Bank Limited

The top foreign banks include:

HSBC

Citibank

ABN AMRO

BNP Paribas, and so on

Requirements to open a business or commercial bank account in Singapore

Although some of the procedures may vary, the basic documentation requirement to open a business or small business bank account remains the same.

The start-up registration documents (if you are a start-up)

Application Form

Copy of the company’s certificate of incorporation

Copy of the company’s business profile

Certified copy of company’s Memorandum and Articles of Association (MAA)

Passport Copies or Singapore national identification cards of all the company signatories or directors

Minimum deposit amount

The factors to consider while opening a digital business bank account

After you have decided that you open a business bank account, it is essential to consider certain factors to reap most of the benefits of the banking facilities. Hence, here are the top factors you should look into before finalising your preferred bank.

Bank reputation and creditworthiness

Expertise in the niche area

Types of account availability

Banking channel service availability

Automated services

Ease of access to the account(s)

Physical location and access

Banking support facilities

Interest rates and fees

Initial deposit and minimum balance requirements

Ease of account opening

Conclusion

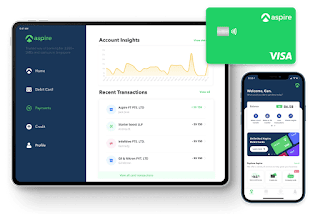

Almost all bank accounts in Singapore offer comprehensive services for business bank accounts. However, if you want to get engaged with up-to-date banking services, the team of Aspire can surely help you. They can assist you in opening corporate business accounts that are fully automated. Call Aspire or mail them to learn more.

Comments

Post a Comment