The Reasons Why We Love Open Business Account Online

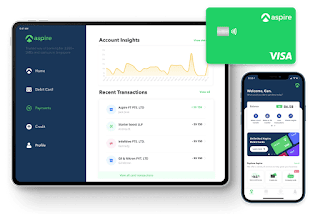

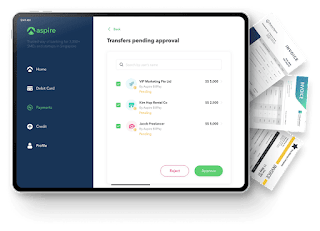

When you're ready to start taking or spending money as a business, open a business account. A corporate bank account keeps you protected and complying with the law. It also has advantages for your clients and staff. Nowadays, you can open a business account online with the help of Aspire very easily in a short while. Objectives Of Online Business Account In Singapore Improve Service. Save time. Time taken by customers. Elapsed time for process. Reduce process errors. Reduce the cost of core service provision. Free staff to provide value added services. Improve morale. Give people the tools and time they need. Advantages Of Online Business Account In Singapore There are advantages of open business account online , these are- Quicker and easier communications. Strengthened marketing capabilities and reach. Increased hours of operation (a website provides 24 hour 7 day information to existing and potential customers). Access to broader information through research. Reducing the