The Reasons Why We Love Open Business Account Online

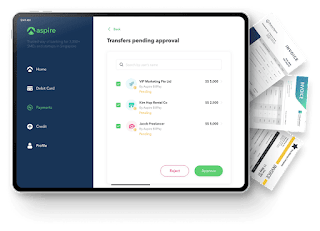

When you're ready to start taking or spending money as a business, open a business account. A corporate bank account keeps you protected and complying with the law. It also has advantages for your clients and staff. Nowadays, you can open a business account online with the help of Aspire very easily in a short while.

Objectives Of Online Business Account In Singapore

Improve Service.

Save time.

Time taken by customers.

Elapsed time for process.

Reduce process errors.

Reduce the cost of core service provision.

Free staff to provide value added services.

Improve morale.

Give people the tools and time they need.

Advantages Of Online Business Account In Singapore

There are advantages of open business account online, these are-

Quicker and easier communications.

Strengthened marketing capabilities and reach.

Increased hours of operation (a website provides 24 hour 7 day information to existing and potential customers).

Access to broader information through research.

Reducing the cost of doing business by lowering transaction cost and increasing efficient methods for payment, such as using online banking.

The opportunities to adopt new business models and develop tailored customer support.

If you want to open small business account online, there is a proven sequence of steps in Aspire you may follow to ensure your success. Thousands of individuals have started and grown successful businesses by following the steps below:-

Find a gap in the market and fill it.

Make sales-oriented copy.

Create an easy-to-navigate website.

To increase traffic to your website, use search engines.

Make a name for yourself as an expert.

Email is a great way to stay in touch with your customers and subscribers.

Back-end sales and upselling can help you earn more money.

Some entrepreneurs create a company account with the same bank where they keep their personal accounts. Rates, fees, and options differ from one bank to the next, so shop around to ensure you get the greatest rates and perks. When creating a company checking or savings account, keep the following in mind:

Special incentives for new customers.

Savings and checking account interest rates.

Lines of credit interest rates.

Fees for transactions.

Fees for early termination.

Fees for maintaining a minimum account balance.

When creating a merchant service account, keep the following in mind:

Rate of discount:- The fee payable for each transaction completed.

Fees for transactions:- Address Verification Service (AVS) fees are added to every credit card transaction.

Daily batch costs for ACH:- Fees incurred when credit card transactions are settled for the day.

Minimum monthly fees:- Fees levied if your company fails to fulfil the minimum transaction requirements.

The need for company incorporation in Singapore services and the incorporation of Singapore companies are increasing. Aspire, the best Singapore company incorporation consultants, understands why Singapore is garnering so much corporate interest for business incorporation in Singapore, and we'd like to share our Singapore incorporation knowledge with you. We are in a unique position to provide you a full range of services at the most appealing pricing, greatest value for money, and to assist you in forming a company in Singapore as a top provider of Singapore company incorporation services.

Comments

Post a Comment