The Ultimate Revelation Of Open A New Business Account With Aspire

If you're ready to start taking or spending money in a business, open a new business account. A business bank account keeps you protected and complying with the law. It also has advantages for your clients and staff.

The Advantages Of Having A Business Bank Account With Aspire

You should open a new business account as soon as you start taking or spending money as your business. A checking account, a savings account, a credit card account, and a merchant services account are all common business accounts. You may accept credit and debit card transactions from your customers with a merchant services account. Once you've obtained your federal EIN, you may create this account. Most corporate bank accounts come with benefits that a normal personal bank account does not.

Protection:- By keeping your business and personal finances separate, commercial banking provides minimal personal liability protection. Purchase security is also provided by merchant services, which ensures that your customers' personal information is kept safe.

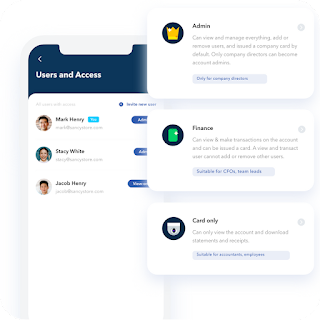

Professionalism:- Customers will be able to pay you with credit cards or checks made payable to your company rather than directly to you. You'll also be able to delegate day-to-day banking duties to workers on behalf of the company.

Preparedness:- A line of credit for the corporation is generally included in business banking. This can be utilised in an emergency or if your company requires new equipment.

Purchasing power:- Credit card accounts can assist your firm in making significant first purchases and establishing a credit history.

Look For A Low-fee Account With Decent Perks Like Aspire Business Bank Account

Some entrepreneurs open a new business account with the same bank where they keep their personal accounts. Rates, fees, and options differ from one bank to the next, so shop around to ensure you get the greatest rates and perks.

When creating a company checking or savings account, keep the following in mind:-

Offers that are introductory in nature.

Savings and checking account interest rates.

Interest rates for lines of credit.

Transaction fees.

Early termination fees.

Minimum account balance fees.

When creating a merchant services account, keep the following in mind:-

The percentage charged for each transaction performed is known as the discount rate.

The amount charged for each credit card transaction is known as transaction fees.

Fees for the Address Verification Service (AVS).

Daily batch costs for ACH: Fees incurred when credit card transactions are settled for the day.

Minimum monthly fees: Fees levied if your company fails to fulfil the minimum transaction requirements.

Payment processing firms are becoming a more attractive option than traditional merchant accounts. Extra functionality, such as accessories that allow you to take credit card payments using your phone, is occasionally provided by payment processing firms.

Get The Paperwork You'll Need To Get A Business Bank Account With Aspire

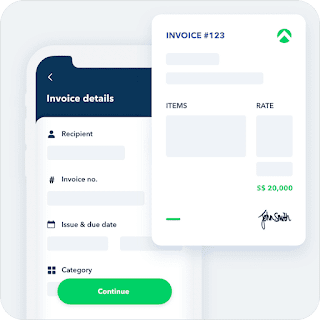

Once you've decided on a bank, opening a corporate account is simple. Visit get started, simply go to a corporation bank online account or a local branch. When opening a business bank account, banks often require the following papers. Some banks may want further information.

Employer Identification Number (EIN) (or, if you're a sole proprietorship, a Social Security number).

Documents pertaining to the creation of your company.

Agreements on ownership.

Business License.

Comments

Post a Comment