Advantages of Online Bank Account Opening in Singapore

Singapore is well-known for having the most refined banking facilities on the planet. It positioned fifth in the 27th version of the Global Financial Centers Index (GFCI) published in March 2020. Singapore has likewise been a hotbed of development in this area and has arisen as a world-driving fintech hub, positioning fifth on the FinTech Index in the GFCI 27 report. The most recent innovation revolution includes "online banking"; the term is utilized to depict banks that work only on the web. It has increased people’s interest in online bank account opening in Singapore.

The Singapore government sees this as an effectiveness and efficiency improving advancement and it has upheld fintech organizations that offer such administrations. It has taken on enactment that approved a few non-banking monetary establishments to offer computerized business representing Singapore-based elements.

Benefits of online bank account

As of late, the Monetary Authority of Singapore has dispatched another drive whereby it will concede banking licenses to full-included computerized banks. So in case you are beginning a Singapore business, and execute for the most part online, the fast-to-open and simple-to-utilize corporate advanced record might be an optimal decision for your organization. Moreover, this digital approach has made invoicing for small businesses easier and flexible.

Online banking is a digital way of new and conventional financial items and administrations. It has made transactions simpler to clients. The term likewise covers online monetary administrations given by non-bank monetary organizations (those that have not acquired a financial permit). Generally, online banking is a form of advanced banking in interchangeable terms.

Online transactions offer convenience of operating banking operations from the comfort of your home and this is cost-efficient to both the bank and its clients. While clients save time and bother through advantageous financial exchanges that can be directed in a hurry from anyplace whenever, banks get a good deal on actual framework and employing costs by moving a piece of their business on the web. You can easily open online bank account in Singapore in five minutes. While in-branch banking will keep on being a piece of the financial business, the advantages of computerized banking can't be disregarded.

Other benefits of opening a bank account online include:

The Bank in your pocket

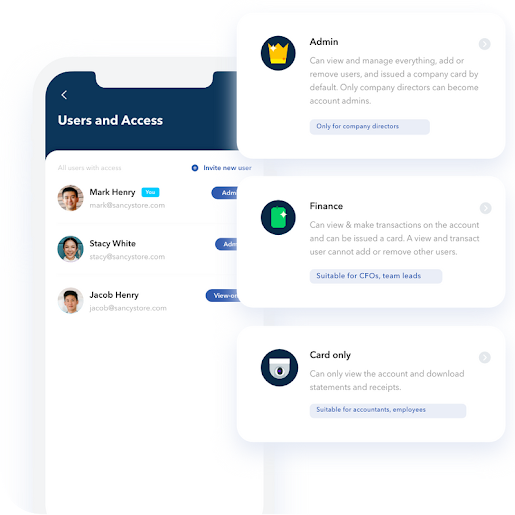

With advanced banking, everything is overseen on your cell phone or PC. Certain organizations actually require that you visit a branch to open an account for the first time, however most grant even this to be done on the web. Note that with certain advanced banks, you can just utilize an application on your cell phone and will not gain admittance to Internet banking through your PC. An online bank account opening in Singapore can be done at any time and from anywhere.

Speedy Account Opening

Most advanced banks offer a lot quicker opening systems contrasted with customary banks for Singapore-consolidated organizations (normally two hours or less).

Lower charges and higher loan costs

Advanced banks cause lower working expenses for keeping up with bank offices and ATMs, which might mean higher financing costs and lower charges for clients.

Quick and modest international exchanges

Conventional banks ordinarily require a trusting that their monetary observing division will check global exchanges, while advanced banks by and large do this naturally and therefore a lot quicker. Expenses for moves are additionally typically lower.

24/7 support

Aspire offers Online banking offers administrations every minute of every day, contrasted with customary banks that might work just during branch working hours.

After knowing all its benefits, are you ready for an online bank account opening in Singapore? If yes, what are you waiting for? Do it now!

Comments

Post a Comment