Remove Your Doubts And Fears About Open Business Bank Account Online

One of the most challenging aspects of open business bank account online is overcoming your fears. Starting a new business is such a huge leap of faith, especially when you are leaving the comfort and security of a stable salary. There are a variety of things that might make any would-be entrepreneur nervous. The fear of failing and taking a risk, as well as the disappointment that comes with failure or losing what you already have, are the most common anxieties. It's terrifying to consider:

Despite everything that was done, the firm collapsed.

It's possible that you'll lose all you've saved.

You risk losing your collateral (your home!) if you are unable to repay your debts.

You may waste a year or two of your life if you discover that your dream business isn't such a good concept after all, and you'll never work again.

Due to unsuccessful commercial collaborations or investments, you wind up with shattered connections.

What is the greatest online business bank account?

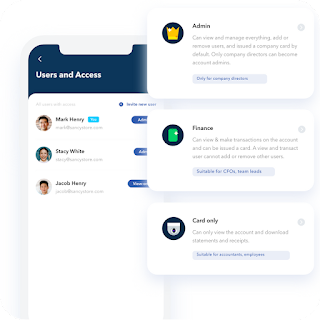

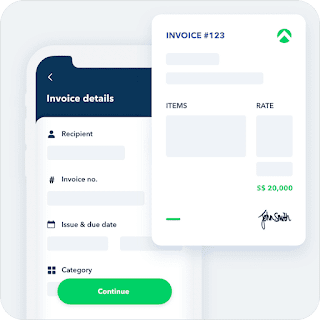

When looking for the finest online business banking account for your purposes, think about the fees and charges you'll have to pay, the advantages you'll get, and whether or not there's a free trial period. The majority of service providers provide comparable features. Aspire adds more features to your online business bank account, allowing you to accomplish more, such as real-time tracking, automatic expenses, and spending silos. You'll need to apply with a new provider and inform them that you're switching from a business account. After that, your new and old providers should interact with each other and allow you to pick your switchover date.

Aspire provides opportunities to new business start ups to open business bank account online in Singapore which could be advanced and trustworthy as well as easy to handle from any location.

What Are the Advantages of Commercial Banking Account Opening Over Other Types of Banking?

Both personal and corporate bank accounts are often opened at commercial banks. When asking for a loan or managing their finances, some people select them. Checking and savings accounts, payment and transaction processing, commercial lines of credit, and loan and mortgage alternatives are among the services they offer. They have more benefits than other forms of banking, such as credit cards. Commercial banks provide more goods and services than credit unions. Commercial bank account opening provides all of the services that a small bank would, as well as CDs, investment accounts, loans, commercial real estate loans, mortgage plans, and the choice of having a debit, credit, or both cards.

5 Reasons You Need A Small Business Credit Cards For New Businesses If You're Self-employed

One of the most compelling reasons to acquire a small company business credit cards for new businesses is that it allows you to keep your business and personal costs separate and track your spending. When it comes to tax season, this makes record-keeping a lot easier. You can quickly monitor your costs and categorise as many deductions as possible with a company credit card. For freelancers, cash flow is always a concern, but Aspire business credit cards provide a revolving line of credit that may be utilised when you need to make a large company purchase, when work is sluggish, or when you're waiting for client checks. Just keep in mind that corporate credit cards, like personal credit cards, come with interest charges and, in certain circumstances, an annual fee.

Comments

Post a Comment