How Invoice Management Solutions Can Help You

For small businesses, like the other financial management and operations, billing management is also an important department to take care of. However, sometimes managing bills can become a burden. If you are new and do not have a dedicated billing management team, you may feel overwhelmed by the large numbers of invoices that need to be processed on a daily basis. Hence, a long term billing management solution is essential for its adoption. Also, in the age of digitization, companies need to move forward with manual data entry and dual processing. They should choose virtual and automated billing management systems. And in this article, we'll show you how they can do just that.

What is the definition of invoice management ?

Let's begin with a simple definition.

Invoice management solutions is also known as invoice processing and is a method that companies use to track and pay supplier invoices. The entire process of managing invoices involves multiple steps including:

Receiving the invoice from a third party

Validating

Paying the supplier

Recording the payment in the company records

Accounts payable invoices and accounts payable automation

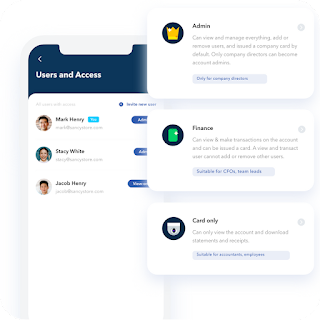

This method appears to take a long time. However, invoice management solutions are not the responsibility of a single person; rather, it is the responsibility of an entire department. As previously indicated, invoice processing or administration entailed more than one step and human involvement. However, this may increase the likelihood of human errors and flaws. As a result, automating the accounts payable process to better handle invoices is always recommended.

Using an automated accounts payable procedure can help the entire invoicing system for small firms. Automation ensures that vendors are paid and that your business receives the goods and services it has requested.

The most effective method for small businesses to manage bills

Now let's look at some of the most effective strategies for small businesses to manage their invoicing.

1. Select the appropriate invoice format (s)

Choose the proper type of invoice for your firm before moving on to the next step in the invoice management solutions. There is no such thing as a "one-size-fits-all" template. So, sit down with your consumer or client and work out a payment plan that works for both of you. You can select from the following options:

Invoices issued in the interim

Invoices that are sent on a regular basis

Invoices at the end

2. Virtually manage your invoices

By managing your invoicing remotely or online, you reduce the possibility of human error. The invoicing system for small enterprises can now be done via websites and mobile invoice apps, thanks to digitization. You may use your device to send invoices, check payment status, and more. You may also automate the order and billing procedures with accounting software.

3. Make use of an invoice app

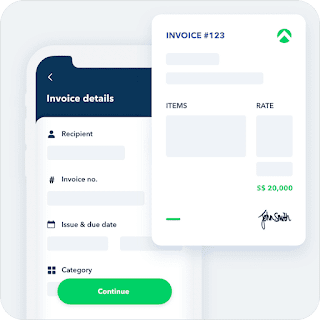

You can not only track and manage your payments online with an invoice software, but you can also update your invoices. You can also cancel and resend existing bills directly from your mobile device, at any time and from anywhere.

Even for tiny firms, there is no shortcut to good invoice handling. If you are new to this industry, we recommend that you pay special attention to handling your invoices to avoid billing and collection mistakes. Aspire can assist you in this endeavour. They provide an automated invoice payment system as well as regular reminders. You may cut down on paperwork and manage your invoicing more efficiently. Visit their website or call them for additional information. Online banking in singapore.

Comments

Post a Comment