Full Knowledge On Singapore Digital Bank In Details

Singapore digital bank whose offers have always been intriguing. The case for computerized banks in Hong Kong is based on the fact that the city-state already has them, and that computerized lenders may help increase financial inclusion — as long as the definition of financial inclusion is broad.

What Are The Requirements For Applying For Computerized Banking Licences?

The following criteria have to met by applicants for the DFB and DWB licences by Aspire:

At least one applicant group organisation has a three-year or longer track record in the e-commerce or technology industries.

Demonstrate the ability to meet both the initial minimum paid capital and the recurring minimum capital funds requirements.

DFB's minimum paid capital was first set at S$15 million (US$11.2 million), before being gradually increased to S$1.5 billion (US$1.12 billion), and

The S$100 million (US$75 million) paid-up capital of DWB.

The computerized bank's business model's long-term viability (a five-year financial prediction of the computerized bank's profitability). An impartial specialist must review the financial projection).

In relation to the operations of the computerized bank, shareholders must give a letter of responsibility and a letter of undertaking.

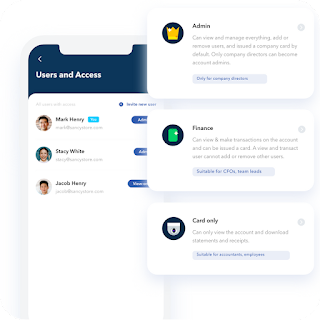

For DFB licences, the applicant must be anchored in Singapore, owned by Singaporeans, and have its headquarters there. You can have a digital business bank account very easily with the help of us.

What Effect Will This Have On The Financial And Banking Sectors In The Region?

The approval of singapore digital bank licences is expected to boost Singapore's banking and finance sector, ensuring that it remains robust, inventive, and competitive, particularly given Hong Kong's approval of eight virtual banking licences in 2019. Many companies will use Singapore as a base from which to expand into other regional markets. Through this Aspire will help you to increase knowledge about computerized banking.

What Role Will Virtual Banking Play In Assisting SMEs?

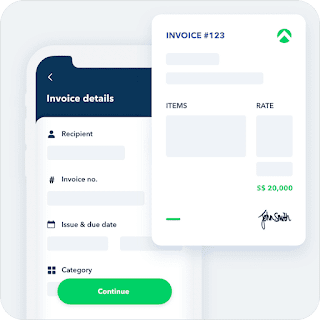

Financial services will be more accessible to underserved groups, such as millennials and small businesses, thanks to singapore digital bank. Indonesia, with 42 million underbanked and 92 million unbanked individuals. Despite this enormous figure, the computerized economy of the country is expected to reach US$124 billion by 2030. The fastest path to establishment and expansion for computerized banks will be through strategic partnerships, notably with payment solution platforms or e-commerce marketplaces. As a result, computerized banks will have access to a larger customer base, allowing them to offer more consumer-centric goods and services than traditional banks. This might involve using alternative credit scoring evaluations to grant microloans to numerous underprivileged SMEs in the region, as well as potentially offering deposit accounts to individuals with no minimum deposit requirements. In the end, the development of computerized banks will push traditional banks to expedite the digitalization of their core business processes and educate their workforce to prepare for this shift. Digital business account is the act of combining each of your clients' financial accounts to a single location in HOA accounting. For these banks, the utilisation of digital technology, big data, and sophisticated analytics will be critical in their efforts to remain the bank of choice for their customers.

Comments

Post a Comment