How can a virtual account save your time?

The development of technology and commercialization of the internet gave rise to Fintech companies. There is a large contribution of technology in the financial industry these days. One such is a virtual account.

Small to medium-sized businesses have loads of responsibilities to handle regularly. Managing finance and accounts is a great task. Large organizations get a team of experts for the purpose, but you can outsource the task as well.

What is a virtual bank account?

It is sometimes known as an online bank account that is either connected to a traditional brick-and-mortar bank or is a completely digital platform for banking operations.

These banks don't have a physical existence, branch office, ATMs, etc. After company incorporation, you can get an account at Aspire. We have low transaction fees, no annual charges, no minimum deposits, attractive interest rates, etc.

Advantages of virtual bank account

At Aspire, we provide you with a range of facilities and services. You can speak to our customer support team and get advisory solutions. Here are a few advantages listed below:

They save your time

You don't need to rush to a bank and get your payments done. Use a virtual account to perform most of your banking activities. Also, we help you during the company incorporation.

Access from anywhere and anytime

These are user-friendly interfaces that can be used anywhere and anytime. All your requirements are at your fingertips and you can focus on business development.

Easily traceable

All your account information is traceable using a mobile application. These are updated information that helps at the time of tax filing. Also, you can track your expenses and make a budget to reduce them.

Easy money transactions

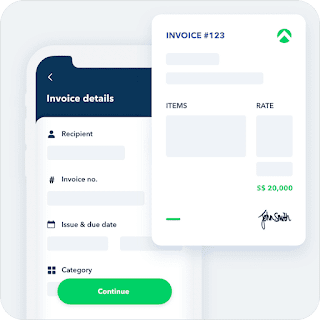

Using FAST and GIRO payments you can transact money from any bank. For international payments, you need to pay a small transaction fee but save five times more than other payment options. Once you open a business account, you will receive a unique account number. Share that with clients to receive payments.

Connect with mobile wallets.

We allow you to connect your virtual account to mobile wallets and make payments. For example, Google Pay, Apple Pay, etc. Also, our payment gateway integration system makes e-commerce business efficient.

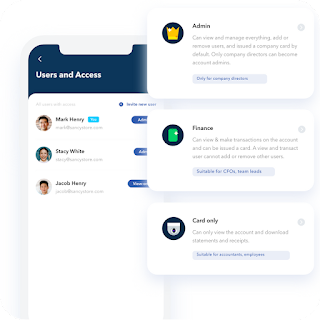

Access to virtual credit cards

We provide you with virtual credit cards as many as you need for every employee. To reduce business expenses you can cut down the credit limit on their cards.

Your credit card is a weapon in an emergency. We approve a line of credit for business growth and you pay back the amount you are using.

Earn cashback and rewards

On every digital spending, Aspire provides 1% cashback. And, our platform partners offer more than $50,000 rewards. Therefore, an SME business account owner can save up money from these.

Conclusion

It may be absurd for people to shift from holding a traditional account to a virtual account, but looking at its advantages you would love to give it a try. Speak to our customer support team at Aspire and get advisory solutions for smooth business functioning and growth over time.

Comments

Post a Comment