How Much Co-operative Is Bank API Integration For Your Businesses

When you're ready to start taking or spending money as a business and you want to save your time then open a bank api integration for your business. A corporate bank account keeps you protected and complying with the law. It also has advantages for your clients and staff.

Objectives Of Online Business Bank Account In Singapore

Time taken by customers.

Elapsed time for process.

Reduce process errors.

Reduce the cost of core service provision.

Free staff to provide value added services.

Improve morale.

Give people the tools and time they need.

Advantages Of E-commerce Payment Processing In Singapore

There are advantages of ecommerce payment processing in singapore, these are-

Increased hours of operation (a website provides 24 hour 7 day information to existing and potential customers).

Reducing the cost of doing business by lowering transaction cost and increasing efficient methods for payment, such as using online banking.

Nowadays, you can open a bank api integration for your business with the help of Aspire very easily in a short while.

If you want accounting services for business in Singapore, there is a proven sequence of steps in Aspire you may follow to ensure your success. Thousands of individuals have started and grown successful businesses by following the steps below:-

Find a gap in the market and fill it.

Create an easy-to-navigate website.

To increase traffic to your website, use search engines.

Email is a great way to stay in touch with your customers and subscribers.

Back-end sales and upselling can help you earn more money.

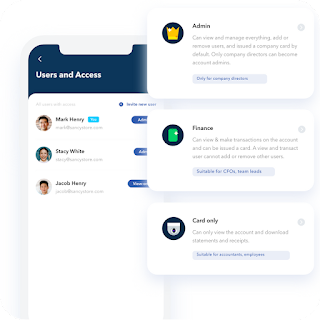

Some entrepreneurs open bank api integration with the same bank where they keep their personal accounts. Rates, fees, and options differ from one bank to the next, so shop around to ensure you get the greatest rates and perks. When creating a company checking or savings account, keep the following in mind:

Special incentives for new customers.

Savings and checking account interest rates.

Lines of credit interest rates.

Fees for transactions.

Fees for maintaining a minimum account balance.

When creating a merchant service account, keep the following in mind:

Rate of discount:- The fee payable for each transaction completed.

Fees for transactions:- Address Verification Service (AVS) fees are added to every credit card transaction.

Daily batch costs for ACH:- Fees incurred when credit card transactions are settled for the day.

Minimum monthly fees:- Fees levied if your company fails to fulfil the minimum transaction requirements.

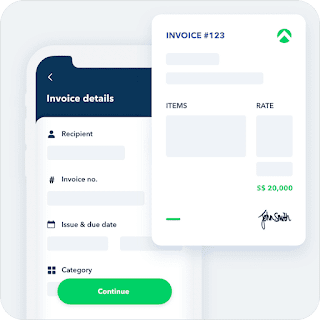

The need for company incorporation in Singapore services and the incorporation of Singapore companies are increasing. Aspire, the best Singapore company incorporation consultants, understands why Singapore is garnering so much corporate interest for the best credit cards for small businesses and incorporation in Singapore, and we'd like to share our Singapore incorporation knowledge with you. A virtual payment account is a bank account that exists only in the virtual world, is transient, and transacts on behalf of a real, physical account. We are in a unique position to provide you a full range of services at the most appealing pricing, greatest value for money, and to assist you in forming a company in Singapore as a top provider of Singapore company incorporation services.

Comments

Post a Comment