If You Need The Best Business Credit Cards For Your Start-up Then Give A Look On This

Best business credit cards are the best way to get the credit you need to expand your company while simultaneously earning cash back, incentives, and other essential advantages to help your company succeed. Now you can find best best credit cards for small businesses with help of Aspire, then have a look at our selection of some best credit cards -

American Express Blue Business Cash Card -

Pros. -

High remuneration rate.

There is no yearly charge.

Cons. -

Spending limit for the year.

Capital One Spark For Business -

Pros. -

High remuneration rate.

There are no international transaction fees.

Cons. -

Has a high yearly charge and a high APR.

Ink Business Cash Credit Card -

Pros. -

There is no yearly charge.

On purchases, there is an introductory APR period.

Cons. -

Good/excellent credit is required.

Budget restraints in bonus categories.

Ink Business Preferred Credit Card -

Pros. -

There are no international transaction fees.

Cons. -

Has a yearly charge.

Brex Card -

Pros. -

Even if you have terrible or no credit, you can qualify.

There is no yearly charge.

There are no international transaction fees.

Cons. -

No introductory APR of 0% .

Marriott Bonvoy Business American Express Card -

Pros. -

High remuneration rate.

There are no international transaction fees.

Cons. -

Has a yearly charge.

The Plum Card From American Express -

Pros. -

High remuneration rate

There are no international transaction fees.

Cons. -

Has a yearly charge.

Is It Possible For Entrepreneurs To Obtain Business Cards?

Because the issuer needs a personal guarantee, a new business with no credit history can acquire a card. That implies that if your company is unable to repay the loan, you will be held personally liable. You should be able to acquire the credit cards for businesses as long as your credit history doesn't make you appear like a dangerous bet to keep up that end of the bargain.

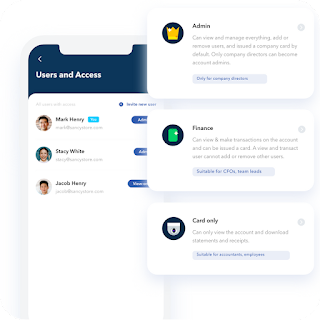

How To Obtain A Business Credit Card For A Start-up Company By Aspire

Know your credit score:- You'll need strong to outstanding personal credit to qualify for most credit cards (typically a FICO score of 690 or above). A financial services corporation may also help you to choose the best business credit cards.

Look at your spending to find the best card:- Consider a card with hotel or airline points if you or your workers travel frequently.

Check for fees:- For a company, every dollar counts, so you might choose a card that helps you pay your expenditures rather than adding to them.

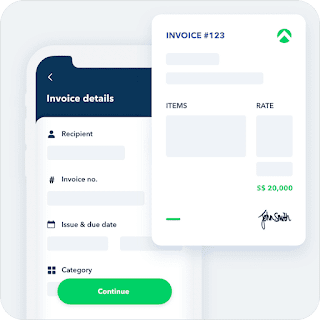

Gather your application materials:- To apply for a card, you'll need to submit basic information about yourself and your new firm, such as your name and social security number for best business credit cards. Most cards don't require a formal company organisation.

Use your card responsibly:- You may begin spending as soon as you receive your new company credit card. If you have any workers, several issuers will provide you free cards, and you'll earn any rewards related to their transactions. You can contact a financial services corporation, which will help you to make your payment process easier.

Comments

Post a Comment