How is a virtual payment account helpful for bill payments?

With the advent of the digital era, technology has taken a step forward in the finance industry. Have you ever wondered when was the last time you issued a check for a personal transaction? Most probably it was some 4-5 years back when a virtual payment account was a new subject.

A business owner has a lot of stuff to do regularly and outsourcing the tasks to Aspire, can let them focus on the mainstream activities of a business. Think how easy it would be if your bill payments were automated.

What is a virtual bank account?

The fintech industry has seen an exponential growth of virtual accounts since last year. But what is a virtual bank? It is similar to traditional banks except for the fact that these banks have no physical existence, branches, or ATMs. Once you open a virtual business account, we issue virtual cards for efficient account payable process automation.

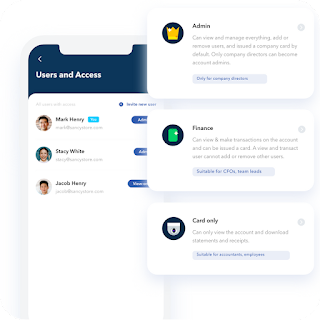

This consists of a unique account number. The owner or admin of the account can share the number with clients to make a transaction via FAST and GIRO payments. Also, we connect your Aspire account with mobile wallets like Google Pay and Apple Pay.

How is the billing process automated with a virtual account?

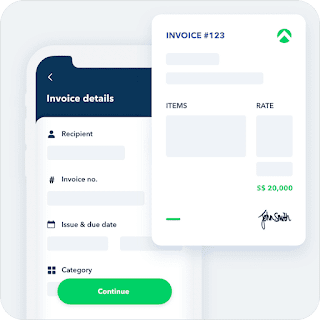

Paying off bills and invoices is made simple, easy, and convenient for us. What do you need to do? Just forward all your invoices to us via email and attach additional information if required. This may be the date of payment or some other instructions.

We schedule your bill payments and initiate the transaction. You get a notification from us when you need to log in with your aspire account and approve the bills. This is where you can make changes or edits if needed. You deposit the entire amount and we pay bills before time on behalf of you.

This prevents late payment charges and keeps a good credit score with a great professional image.

Reasons why virtual accounts for bill payments are more in demand.

It streamlines the account payment process.

It's time to replace outdated and cumbersome paper checks and inefficient manual processing with a virtual payment account. The account payable department can focus on other financial responsibilities other than payment processing. With virtual cards, the entire account payment process gets streamlined and easy to do.

Better cash flow.

A financial services corporation asks you to manage cash flow but we help you in cash flow management with a group of experts. Our instant reconciliation feature makes sure that your account books remain tidy and detailed. Also, we make reports of every transaction and help you during tax filing and auditing.

Helps in expense management of the company.

When you open a virtual business account at Aspire, we provide free virtual cards for all your employees. You can lower down the credit limit on their cards according to the annual budget of your company. Managing these cards virtually is easier and more convenient than physical branch visits.

Conclusion

When having a virtual payment account comes with a range of advantages, business owners can consider having one at Aspire. You can also take credits from us for business growth along with advisory solutions.

Comments

Post a Comment