ADVANTAGES OF BUSINESS CREDIT CARDS FOR STARTUPS

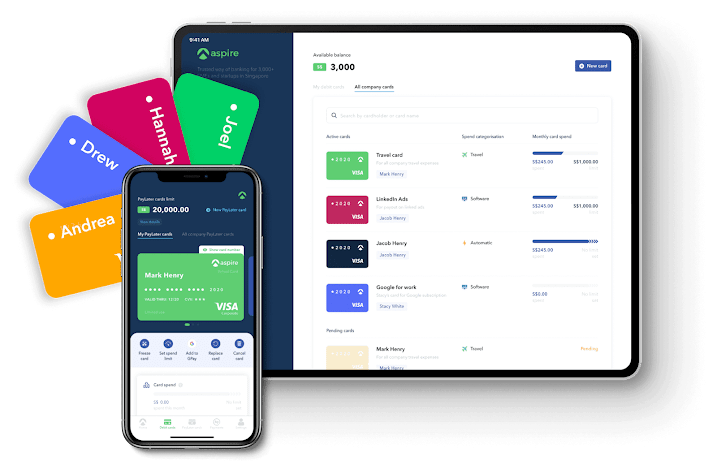

A personal credit card can undoubtedly be used to run a business, but a small business card includes characteristics that a personal card does not. Small business cards, for example, might provide cash back on purchases of office supplies and other benefits that a startup need. They also include online tools to help you keep track of your business costs, as well as the ability to add more users while restricting their access. Small business cards are not to be confused with corporate credit cards. You're individually liable for the expenses if you use a small business credit cards for startups . That implies you'll have to pay it all back if your business fails. You'll get benefits that meet your business needs that you won't get with a personal credit card because these cards are targeted to business owners. These advantages include: 1. GETTING YOUR BUSINESS EXPENSES IN ORDER You must be structured in order to secure your personal assets and keep them distinct from y...