ADVANTAGES OF BUSINESS CREDIT CARDS FOR STARTUPS

A personal credit card can undoubtedly be used to run a business, but a small business card includes characteristics that a personal card does not. Small business cards, for example, might provide cash back on purchases of office supplies and other benefits that a startup need. They also include online tools to help you keep track of your business costs, as well as the ability to add more users while restricting their access.

Small business cards are not to be confused with corporate credit cards. You're individually liable for the expenses if you use a small business credit cards for startups. That implies you'll have to pay it all back if your business fails.

You'll get benefits that meet your business needs that you won't get with a personal credit card because these cards are targeted to business owners. These advantages include:

1. GETTING YOUR BUSINESS EXPENSES IN ORDER

You must be structured in order to secure your personal assets and keep them distinct from your corporate assets. Using business credit cards for startups will assist you in organising and tracking your business spending while also keeping them separate from your personal expenses.

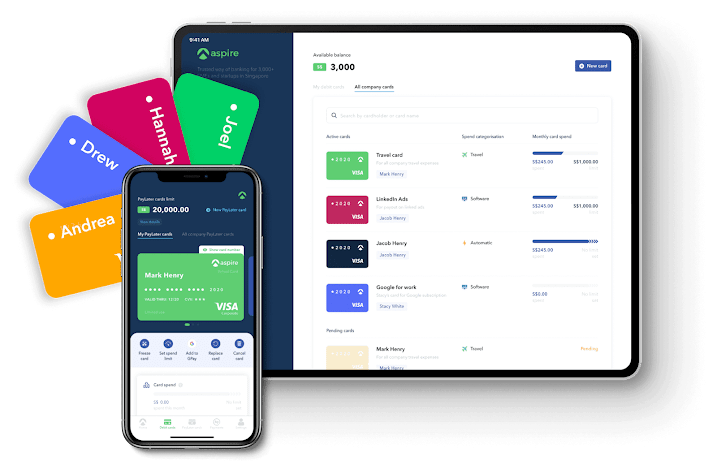

Many small company credit cards have online record-keeping services, which can be handy when combined with accounting software like Aspire to help you monitor where your money is going. You can also manage the authorised users of your credit card as a business owner to better secure your company.

2. SIGN-UP BONUSES OF IMPORTANCE

Many company credit cards provide sign-up bonuses to those who choose to use them. These incentives may come in the form of points, airline miles, or cash back.

Some cards will also provide 0% APR financing for up to 12 months after you sign up for the card. You won't have to pay any interest on your new card during this time.

While many of these benefits can be valuable, it's crucial to keep in mind that many of the cards with large sign-up bonuses also have higher annual fees.

3. SPECIFIC REWARDS

When looking for a small company credit card, look for one that has a rewards programme that you can use.

Some reward you with double points for every dollar you spend on office supplies and shipping. Others follow suit when it comes to phone, cable, and internet services. You can also locate cards that provide free access to ZipRecruiter and Google G Suites for up to a year. So, if you have certain business needs, you'll most likely be able to discover a card that will reward you in those areas.

4. ESTABLISHING YOUR COMPANY'S CREDIT HISTORY

A small company credit card can help you build your business credit cards for new businesses scores in the same way that a personal credit card may help you build your personal credit score.

The longer you make on-time payments and keep your credit limit below your credit limit, the more likely you are to qualify for other types of credit with low interest rates. Of course, if you miss payments or have a lot of debt, this benefit becomes a disadvantage.

Business credit cards for startups from Aspire will help you grow your business.

We've put up a list of the finest credit cards for small business owners. Accounting services in Singapore can help you build your business with our credit solutions. Entrepreneurial cashback and rewards may help you get the most out of your money. Our complete finance team solutions can assist you in accelerating your growth. Online, you can open a small business account with us. Online bank account opening singapore.

Comments

Post a Comment