Know more about neobank Singapore

Aspire has launched an all-in-one banking platform for business owners, and is a neobank Singapore. Most people confuse neobank with digital banks. The only similarity between them is all the banking operations are performed via smartphone or computer. These banks don't have a physical branch and are operated via digital platforms. Neobanks doesn't offer a wide range of consumer banking services but targets a selected market base with their products.

Types of Neobanks in Singapore

Here is a list of a few popular neobanks in Singapore.

Transferwise: It is one of the world's leading neobanks for international money transfer, with low transaction fees and exchange rates.

Youtrip: This is suitable for travelers as it offers a multi-currency travel wallet with money exchange for 10 major currencies. The real-time exchange rates are comparatively better than the bank’s FX rates.

Revolut: This is a global money app that allows users to spend multiple currencies and international money transfers. The exchange rate is too low, and there are no transaction fees. These have an in-built expense tracker that categorizes your business spending and budgeting.

Aspire is a Singapore digital bank that offers a wide range of services to business owners on opening a business account. We perform all your financial activities and give you time to explore new business opportunities and ideas.

What are the advantages of Neobanks?

A few advantages of neobank Singapore at Aspire are listed below:

Lower fees: In comparison to other online banks, these have lower costs associated with maintaining business accounts. Mostly, these don't have signup fees, a minimum deposit, monthly fees, or other costs associated with account maintenance.

Create an account quickly: With Aspire, you can create a business account within 5 minutes. Here, you don't have to wait in a long queue to speak with a customer executive. Instead, we provide 24/7 customer support during account opening.

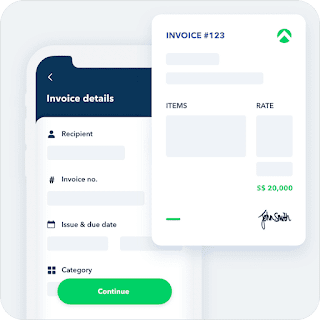

Convenient payments: Making local and international payments with neobanks is easy, simple, and convenient. Aspire allows using FAST and GIRO payments for free to send and receive money across any bank account. For international payments, we allow multiple currencies, low transaction fees, and low exchange rates.

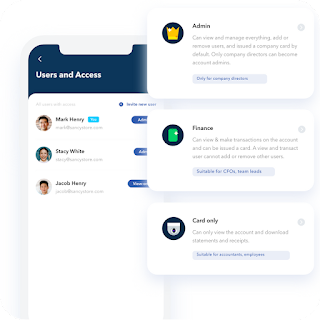

Security: These banks implement two-factor authorization for extra secure transactions. Also, we implement the highest digital security encryption algorithms and the access protocol to ensure your data remains protected with us. The cards have advanced fraud protection and every transaction made is automatically synced with your accounting software.

Seamless integration: They integrate with top business software, mobile wallets, and accounting software. This keeps your book clean, and the money received gets transferred to your Aspire account.

SME banking Singapore has become popular with neobanks and digital banks for financial aids that traditional banks may not provide.

Conclusion

Neobank Singapore is the latest tool in the fintech industry, and it has yet a lot to do. Large enterprises or business owners comfortable with the traditional banking system, may not find these banks efficient enough to provide financial assistance. But startups or small business owners can consider us to make your dream come true.

Comments

Post a Comment